The Future of Insurance: Trends and Predictions

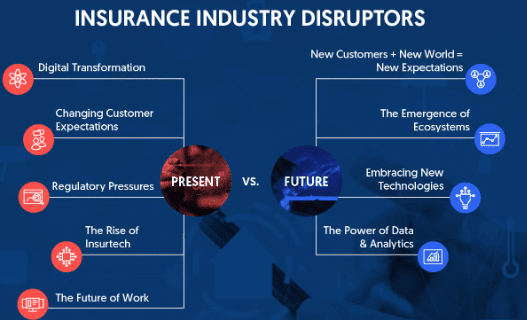

The future of insurance is likely to be shaped by several key trends and predictions: Personalization and Data Analytics: Insurance companies will increasingly leverage data analytics and artificial intelligence to personalize policies and pricing. This trend allows insurers to better understand individual risks and offer tailored coverage, resulting in more accurate pricing and improved customer satisfaction. Digital Transformation: The insurance industry will continue to undergo digital transformation, with more processes moving online and the adoption of

technologies such as blockchain for secure transactions and smart contracts for automated claims processing. Usage-Based Insurance (UBI): UBI, also known as pay-as-you-go or telematics insurance, will become more prevalent. This model utilizes data from IoT devices such as telematics sensors in vehicles or wearable devices to track usage and behavior, allowing insurers to offer more flexible and personalized pricing based on actual risk. Cyber Insurance: With the increasing frequency and sophistication of cyberattacks, the demand for cyber insurance will continue to

rise. Insurers will develop specialized policies to cover businesses and individuals against cyber risks, including data breaches, ransomware attacks, and other digital threats. Climate Change and Natural Disasters: As the impacts of climate change become more pronounced, insurance companies will face greater challenges in assessing and managing risks related to extreme weather events, such as hurricanes, wildfires, and floods. Insurers may need to adjust their underwriting practices and pricing models accordingly. Emerging Risks: Insurance companies will need to stay ahead of emerging risks associated with technological advancements, such as autonomous vehicles, drones, and artificial intelligence. These new technologies bring both opportunities and challenges, requiring insurers to

adapt their products and services to address evolving risks. Regulatory Changes: Regulatory developments will continue to shape the insurance landscape, with governments implementing new laws and regulations to address emerging risks, consumer protection, and data privacy concerns. Insurers will need to stay compliant with evolving regulatory requirements while also balancing innovation and growth. Shift in Customer Expectations: Customer expectations are evolving, driven by experiences in other industries such as retail and banking. Insurers will need to focus on enhancing the customer experience, offering seamless digital interactions, faster claims processing, and

more personalized services to meet changing consumer demands. Collaboration and Partnerships: Insurance companies will increasingly collaborate with InsurTech startups, technology firms, and other industry players to drive innovation, enhance capabilities, and expand market reach. These partnerships can facilitate the development of new products, services, and distribution channels. Health and Wellness Initiatives: With growing awareness of health and wellness, insurance companies will invest in initiatives to promote preventive care, wellness programs, and lifestyle incentives. These efforts can help reduce healthcare costs, improve customer health outcomes, and mitigate risks associated with chronic diseases. Overall, the future of insurance will be characterized by technological

innovation, shifting customer expectations, and a dynamic regulatory environment. Insurers that embrace these trends and adapt proactively will be well-positioned to succeed in the evolving insurance landscape.Personalization and data analytics are transforming the insurance industry in several ways: Risk Assessment and Underwriting: Insurers are increasingly using advanced analytics techniques, including machine learning and predictive modeling, to assess risks more accurately. By analyzing vast amounts of data from various sources such as customer

demographics, claims history, credit scores, and IoT devices, insurers can better understand individual risk profiles. This enables them to tailor coverage and pricing more precisely, offering lower premiums to lower-risk customers and adjusting rates for higher-risk individuals accordingly. Customer Segmentation: Data analytics allows insurers to segment their customer base more effectively based on demographics, behaviors, and preferences. By identifying specific customer segments with distinct needs and characteristics, insurers can develop targeted marketing strategies and personalized product offerings. For example, insurers may offer specialized policies for young drivers,

homeowners in high-risk areas, or individuals with specific health conditions. Fraud Detection and Prevention: Data analytics plays a crucial role in detecting and preventing insurance fraud. Insurers use advanced algorithms to analyze patterns and anomalies in claims data, identifying suspicious behavior indicative of fraudulent activity. By leveraging data analytics tools, insurers can detect fraudulent claims more quickly and accurately, reducing losses and protecting profitability. Customer Experience Enhancement: Personalization through data analytics enables insurers to deliver a more seamless and personalized customer experience. By leveraging customer data and

predictive analytics, insurers can anticipate customer needs, provide relevant recommendations, and streamline the insurance buying process. For example, insurers may use chatbots or virtual assistants to interact with customers, offering personalized advice and assistance in real-time. Tailored Products and Services: Data analytics enables insurers to develop tailored products and services that meet the specific needs of individual customers. By analyzing customer data and market trends, insurers can identify emerging risks and opportunities, designing innovative insurance solutions to address evolving customer needs. For example, insurers may offer usage-based insurance

policies for vehicles, pay-as-you-go health insurance plans, or on-demand insurance coverage for specific events or activities. Risk Management and Mitigation: Data analytics allows insurers to proactively manage and mitigate risks by identifying potential hazards and implementing preventive measures. By analyzing historical data and predictive models, insurers can assess the likelihood and severity of various risks, developing risk mitigation strategies to minimize potential losses. For example, insurers may offer risk management services, safety recommendations, or

discounts for policyholders who take proactive steps to reduce risks. Overall, personalization and data analytics are driving significant advancements in the insurance industry, enabling insurers to better understand their customers, assess risks more accurately, and deliver tailored products and services that meet evolving customer needs. By leveraging data analytics effectively, insurers can enhance customer satisfaction, improve operational efficiency, and gain a competitive edge in the marketplace.