Auto Insurance Demystified: What You Need to Know Before You Hit the Road

Auto insurance can often seem like a complicated and overwhelming topic, but understanding the basics before hitting the road can help ensure you’re adequately protected. Here’s a breakdown of what you need to know: 1. Types of Coverage: Liability Coverage: This covers damages you cause to others’ property or injuries to others in an accident where you’re at fault. Collision Coverage: This pays for damages to your own vehicle in case of a collision, regardless of fault. Comprehensive Coverage: Covers damages to your vehicle caused by incidents other than

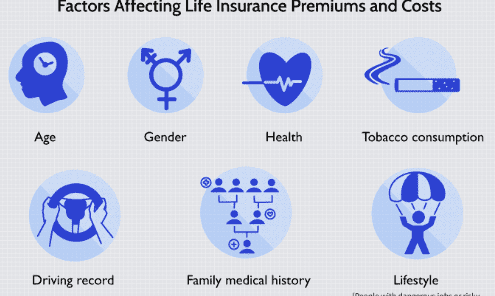

collisions, such as theft, vandalism, or natural disasters. Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who has insufficient or no insurance. 2. Factors Affecting Premiums: Driving Record: A clean driving record typically results in lower premiums. Vehicle Type: The make, model, and age of your car can impact your premium. Coverage and Deductibles: Higher coverage limits and lower deductibles usually lead to higher premiums. Location: Where you live and park your car affects premiums due to crime rates and accident frequency. Credit Score: In some regions, insurers consider credit scores when calculating premiums.

Age and Gender: Younger drivers and males generally pay higher premiums due to statistically higher accident rates. 3. Discounts: Safe Driver Discounts: Offered to those with a clean driving record. Multi-Policy Discounts: Bundling auto insurance with other policies like home or renters insurance can result in savings. Safety Features: Vehicles equipped with safety features like anti-theft systems, airbags, and anti-lock brakes may qualify for discounts. Low Mileage: If you don’t drive much, you may be eligible for lower rates. Good Student Discounts: Available for students

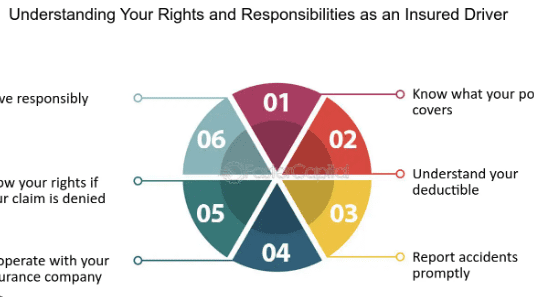

with good grades. 4. Minimum Requirements: Each state sets its own minimum liability coverage requirements, so be sure to know what’s required where you live. Minimum requirements may not be enough to fully protect you in the event of a serious accident, so consider higher limits. 5. Claims Process: Understand how to file a claim and the steps involved. Promptly report accidents to your insurer. Keep documentation and records related to the accident. 6. Review and Update: Periodically review your coverage to ensure it still meets your needs. Update your policy if your circumstances change, such as moving to a new location or purchasing a new vehicle. 7. Comparison Shopping

: Rates can vary significantly among insurers, so shop around for the best deal. Consider factors beyond price, such as customer service and claims satisfaction. By understanding these key aspects of auto insurance, you can make informed decisions to protect yourself and your vehicle while on the road.Here are some additional points to consider: 8. Deductibles: A deductible is the amount you’re responsible for paying out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but make sure you can afford the out-of-pocket expense if you need to make a claim. 9. Usage-Based Insurance: Some insurers offer usage-based insurance (UBI), where premiums are based on your driving habits, such as mileage, speed, braking, and time of day. UBI programs often involve installing a device in your car or using a mobile app to track your driving behavior. 10. Coverage for Additional Drivers: If other people regularly drive your car, consider adding them to your policy or ensuring they’re covered under permissive use. Not listing all drivers who have regular access to your vehicle could

result in denied claims or higher premiums. 11. Gap Insurance: If you lease or finance your vehicle, consider gap insurance to cover the difference between what you owe on the loan or lease and the car’s actual cash value if it’s totaled. 12. Insurance for Rental Cars: Your auto insurance policy may provide coverage for rental cars, but it’s essential to check your policy details before declining coverage offered by the rental company. Some credit cards also offer rental car insurance coverage if you use them to pay for the rental. 13. SR-22 and FR-44 Insurance: If you’ve been convicted of certain driving offenses, such as DUI/DWI, your state may require you to file an SR-22 or FR-44

form as proof of insurance. These forms are typically associated with higher-risk drivers and may result in increased premiums. 14. Understanding Policy Terms: Take the time to read and understand your policy documents, including terms, conditions, and exclusions. If you have questions, don’t hesitate to reach out to your insurance agent or company for clarification. 15. Consider Umbrella Insurance: If you want additional liability coverage beyond what your auto insurance provides, consider umbrella insurance, which offers extra protection against large liability

claims. 16. Maintain Coverage: Continuous auto insurance coverage demonstrates responsibility and can lead to lower premiums over time. Letting your coverage lapse could result in higher rates when you reinstate coverage or when shopping for a new policy. By considering these additional points, you can further enhance your understanding of auto insurance and ensure you have the coverage you need before hitting the road.