The Impact of COVID-19 on the Insurance Industry: Lessons Learned and Moving Forward

The COVID-19 pandemic has significantly impacted the insurance industry in various ways, prompting lessons learned and adaptations for moving forward. Here are some key points: Increased Claims Volume and Payouts: COVID-19 resulted in a surge of insurance claims across multiple lines of business, including health, life, travel, and business interruption insurance. Insurers faced challenges in managing the increased volume of claims and estimating the associated financial liabilities accurately. Operational Disruptions: The pandemic forced insurers to

quickly adapt their operations to remote work setups to ensure business continuity. This transition posed challenges in terms of maintaining productivity, cybersecurity, and communication among teams and with clients. Reassessment of Risk Models: Insurers had to reassess their risk models in response to the pandemic’s unique risks and uncertainties. This involved incorporating new data and scenarios related to pandemics, business closures, supply chain disruptions, and other relevant factors into their risk assessment frameworks. Product Innovation and Adaptation: The pandemic highlighted gaps in coverage and exposed the need for new insurance products tailored to emerging risks. Insurers have been innovating and adapting their product offerings to address evolving customer

needs, such as pandemic-specific business interruption insurance, event cancellation insurance, and telemedicine coverage. Customer Expectations and Digital Transformation: The pandemic accelerated the shift towards digital interactions and self-service options in the insurance industry. Customers increasingly expect seamless online experiences for purchasing policies, filing claims, and accessing support. Insurers have been investing in digital transformation initiatives to enhance their digital capabilities and meet changing customer expectations. Regulatory Changes and Compliance: Regulators responded to the challenges posed by the pandemic by introducing temporary

measures and guidance to facilitate insurance operations and ensure consumer protection. Insurers have had to navigate evolving regulatory requirements and compliance obligations amidst the rapidly changing landscape. Moving forward, the insurance industry will likely continue to adapt and evolve in response to the lessons learned from the COVID-19 pandemic. Key areas of focus may include: Strengthening resilience and preparedness for future pandemics and other catastrophic events. Enhancing risk management practices and scenario planning to better

anticipate and mitigate emerging risks. Investing in technology and data analytics to improve operational efficiency, customer experiences, and risk assessment capabilities. Collaborating with stakeholders, including regulators, policymakers, and industry partners, to address systemic challenges and promote industry-wide resilience. Maintaining a customer-centric approach and leveraging insights gained from the pandemic to tailor products and services to meet evolving customer needs and preferences. Overall, the COVID-19 pandemic has been a catalyst for

change in the insurance industry, prompting insurers to rethink traditional practices, embrace innovation, and prioritize resilience in preparation for future challenges.The COVID-19 pandemic led to a notable increase in insurance claims across various sectors, resulting in significant payouts for insurers. Here are some specific details regarding the increased claims volume and payouts: Health Insurance: Hospitals and healthcare facilities experienced a surge in patients requiring treatment for COVID-19-related illnesses. Insurers faced a higher volume

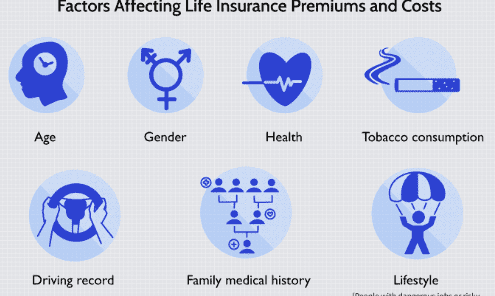

of claims for hospitalizations, medical treatments, testing, and other healthcare services related to the virus. Additionally, there were increased claims for telemedicine consultations and mental health services as individuals sought alternative ways to access healthcare during lockdowns and social distancing measures. Life Insurance: The pandemic prompted a heightened awareness of mortality risks, leading to increased demand for life insurance coverage. Insurers saw a surge in applications for life insurance policies as individuals sought to protect their families financially in the event of their death due to COVID-19 or other causes. This resulted in higher payouts for

life insurance claims, particularly for policies covering COVID-19-related deaths. Travel Insurance: With travel restrictions and cancellations of flights, cruises, and other travel plans, insurers experienced a surge in travel insurance claims. Policyholders sought reimbursement for canceled trips, flight cancellations, medical emergencies abroad, and other travel-related losses. Insurers faced challenges in processing these claims efficiently due to the sheer volume and complexity of cancellations and travel disruptions. Business Interruption Insurance: The pandemic led to widespread business closures and disruptions across industries, triggering claims under business

interruption insurance policies. Insurers faced debates and legal challenges over coverage for pandemic-related losses, particularly regarding the interpretation of policy language and the applicability of exclusions. The significant payouts resulting from these claims highlighted the need for clearer policy language and risk assessment methodologies for future pandemics and catastrophic events. Workers’ Compensation Insurance: Essential workers, such as healthcare professionals, first responders, and frontline workers, faced increased risks of exposure to

COVID-19 in their workplaces. Insurers saw higher claims for workers’ compensation benefits related to COVID-19 infections, occupational illnesses, and workplace injuries. The pandemic underscored the importance of adequate workplace safety measures, risk mitigation strategies, and insurance coverage for employee health and safety. Overall, the increased claims volume and payouts resulting from the COVID-19 pandemic presented significant financial and operational challenges for insurers. The pandemic highlighted the importance of robust risk

management practices, adequate reserves, and flexibility in insurance policies to respond effectively to emerging risks and unforeseen events. Insurers continue to assess the long-term impacts of the pandemic on claims experience, pricing, underwriting, and product development strategies moving forward.